contra costa county sales tax history

Find homes for sale in Contra Costa County CA or type an address below. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Contra Costa County CA at tax lien auctions or online distressed asset sales.

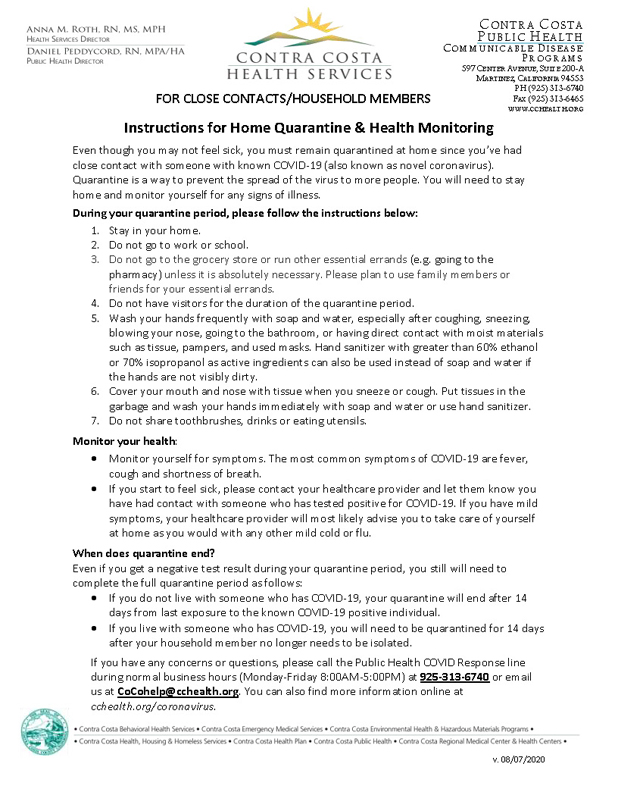

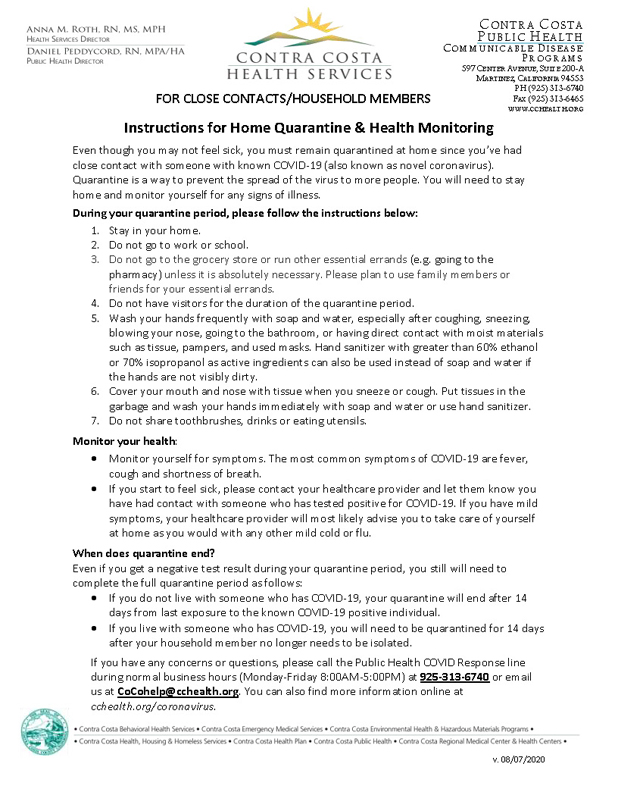

Coronavirus Covid 19 Information City Of Antioch California

Weve collated all the information you need regarding Contra Costa taxes.

. The contra costa county sales tax rate is. It was raised 05 from 825 to 875 in April 2021. Sales Tax Breakdown.

California State Property Tax. Peruse rates information view relief programs make a payment or contact one of our offices. During the Civil War a CCCHS virtual event Mar 26 2022 Flor do Oakley Holy Ghost Society Crab Dinner Dine-In Or Drive-Thru 2022.

Welcome to the Tax Portal. Income Tax Rate Indonesia. The Contra Costa County sales tax has been changed within the last year.

A county-wide sales tax rate of 025 is. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Restaurants In Matthews Nc That Deliver.

The purpose of the Property Tax Division is. A county-wide sales tax rate of 025 is. Walnut Creek City Sales Tax.

The current total local sales tax rate in contra costa county ca is 8. This is the total of state and county sales tax rates. Heres how Contra Costa Countys maximum sales tax rate of 1075 compares to other counties.

Several government offices in Concord and. The purpose of the property tax division is. Posted Fri Sep 11 2020 at.

Contra Costa County Sales Tax Calculator. The Bay Area was up 36. Essex Ct Pizza Restaurants.

The Contra Costa County Sales Tax is 025. A Concord Property Records Search locates real estate documents related to property in Concord California. Net of aberrations taxable sales for all of Contra Costa County grew 23 over the comparable time peri - od.

Delivery Spanish Fork Restaurants. A yes vote supported authorizing an additional sales tax of 05 for 20 years generating an estimated 81 million per year for essential services including the regional hospital community health centers emergency response safety-net services early childhood services and protection of vulnerable populations thereby increasing the total sales tax rate in Contra Costa. The 2018 United States Supreme Court decision in South Dakota v.

El Cerrito residents will vote on increasing sales taxes in Contra Costa County. The local sales tax rate in contra costa county is 025 and the maximum rate including california and city sales taxes is 1025 as of january 2022. None of the cities or local governments within Contra Costa County collect additional local sales taxes.

California State Sales Tax. Contra Costa County CA Property Records. Contra Costa County Property Tax.

They are a valuable tool for the real estate industry offering. Has impacted many state nexus laws and sales tax collection requirements. Contra Costa County CA currently has 985 tax liens available as of May 2.

36 rows The Contra Costa County Sales Tax is 025. See Property Tax Publications. To review the rules in California visit our state-by-state guide.

A county-wide sales tax rate of 025 is applicable to localities in Contra Costa County in addition to the 105 Puerto Rico sales tax. Soldier For Life Fort Campbell. Wwwcctaxus Comments or Suggestions.

California State Income Tax. To build the countywide tax roll and allocate and account for property tax apportionments and assessments for all jurisdictions in the county. Contra Costa County Sales Tax.

Public Property Records provide information on land homes and commercial properties in Concord including titles property deeds mortgages property tax assessment records and other documents. The Contra Costa County sales tax rate is. The California state sales tax rate is currently.

Q4 2015 Contra Costa County Sales Tax Update 0 1000 2000 3000 4000 SALES PER CAPITA Unincorporated County Q4 12 Q4 15 Q4 13 Q4 14 County California 49 BusInd. To assist in the issuance and administration of the Tax and Revenue Anticipation Notes and other bond programs. Bay City News News Partner.

Sales Tax Breakdown. In 1988 Contra Costa County voters approved Measure C a one-half percent sales tax that generated 1 billion in funding over 20 years. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Camino 7250 El Dorado Camp Beale 7250 Yuba Camp Connell 7250 Calaveras Camp Curry 7750 Mariposa Camp Kaweah 7750 Tulare Camp Meeker 8125 Sonoma Camp Nelson 7750 Tulare Camp Pendleton 7750 San Diego.

They are maintained by various government offices in Contra Costa County California State and at the Federal level. Opry Mills Breakfast Restaurants.

Why The Caltrain Sales Tax Wins Even If It Loses In Santa Clara County Kqed

Covid 19 Home City Of Antioch California

Covid 19 Home City Of Antioch California

The African Slave Trade From The Fifteenth To The Nineteenth Century Reports And Papers Of The Meeting Of Experts Organized By Unesco At Port Au Prince Haiti 31 January To 4 February 1978

Covid 19 Home City Of Antioch California